DISCRETIONARY PORTFOLIO MANAGEMENT

A customized service that fits the Clients’ circumstances, investment objectives, risk profile and expectations on projected return.

Management solutions from €50.000 or $50.000

Investment strategy personalized to the Client profile

Team of Portfolio Managers with extensive experience

Reduced transaction costs

Delegate the management of your portfolio

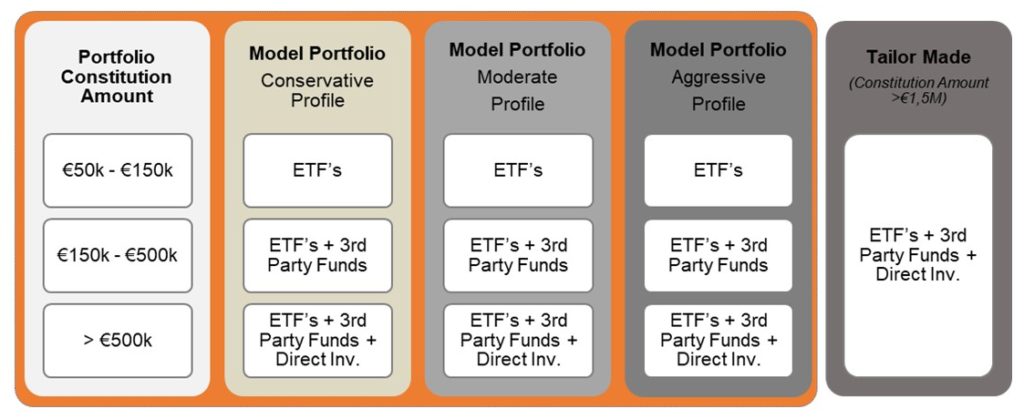

Bison Bank offers 3 types of model portfolios profiled according to the Client’s risk profile or the possibility of designing a personalized portfolio (tailor made). The following table shows the financial instruments that compose each portfolio according to the Client’s investor profile and the amount of the portfolio’s constitution.

The minimum amount for establishing investment portfolios with a conservative, moderate and aggressive profile is €50.000 or $50.000. For the establishment of tailor made investment portfolios, the minimum amount is €1.500.000 or $1.500.000.

. Conservative: Investors with low risk propensity, who want a regular growth on the value of their financial assets, in the short/medium term.

. Moderate: Investors with a moderate risk propensity, who want a medium term appreciation on the value of their financial assets, through a relatively balanced investment between bond and equities’ markets.

. Aggressive: Investors with high knowledge and experience of financial instruments, who want a long-term appreciation of the invested capital, assuming the possibility of significant capital losses in the short term.

Disclaimer

This information does not exempt consultation of the pre-contractual and contractual information legally required and available at the Bank.

Investing in a Discretionary Management Portfolio may result in the loss of invested capital. It is up to the investor to make his decisions, in the light of the respective Investor Profile, and taking into account the applicable laws and regulations. The published returns show past data and are not a guarantee of future returns. The returns shown are average returns for each profile. The returns shown are gross returns, not including management fees and any taxes on capital gains taxed by the client’s IRS.

This document has a purely informative and objective nature, and it is intended solely and exclusively for its addressee. This document is reserved and its dissemination or disclosure is expressly prohibited. In this context, Bison Bank S.A. declines any responsibility for the misuse or abuse of the information contained in this document. On the other hand, any data contained in this document is merely indicative, and may be adjusted according to market changes that, at any given moment, may occur. The information contained in this document is for information purposes only and is not intended to suggest and/or guide its recipients as to the investments and divestments to be made, so it cannot and should not be understood as an investment suggestion or recommendation, namely for the acquisition and/or sale of any securities or financial instruments mentioned in this document or to carry out other types of transactions on them. The information contained herein is not intended and it is not intended to be, and may in no case be configured as investment advisory, as it does not take into account any individual characteristics, such as knowledge, experience, investment objectives and financial profile of a specific person or entity. Therefore, the information contained in this document cannot, nor should it trigger or justify any act or omission by its addressees, nor support any operation, transaction, contract or commitment, not even replace any judgment of their own, which will always be entirely responsible for their acts and omissions.

This document was prepared according to public information and it was not subject to any independent analysis and/or validation (namely by the CMVM or external auditors). For the avoidance of any doubts, Bison Bank S.A. assumes no responsibility for any investment decisions made on the basis of this document.